Think Your Business Is Too Small To Get Hacked? Think Again.

Is your thinking putting you at risk for a Cyber Breach?

Think your business is too small to get hacked? There is one big problem with that thinking. Most of the time hackers do not know who they are attacking. They don’t always target specific companies. They blast out thousands and thousands of phishing emails hoping someone will click on that malicious attachment or link. If someone from your company clicks on a malicious attachment or link, you are no longer too small to get hacked!

According to a SecurityMagazine.com article, 43% of attacks are aimed at SMBs, while only 14% are prepared to defend themselves. On top of that, the National Cyber Security Alliance reports 60% of small and medium businesses that suffer a cyberattack go out of business within 6 months.

You should never assume that your business is too small for a cyber breach. Here is why:

- You have data that is valuable to hackers (i.e., credit card numbers, your bank account, employee personally identifiable information).

- The livelihood of you and your employees could be severely impacted. How would you pay a ransom or for the recovery of your data? Would you have to use the funds from payroll? If you have cyber liability insurance, do you know what your sub-limits are for different types of attacks?

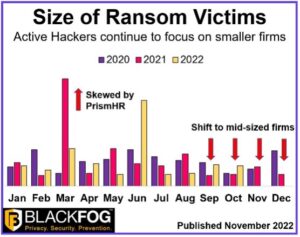

- Attackers assume, and stats back it up, that smaller businesses are not concerned about cyberattacks. They also assume cybersecurity protections SMBs utilize are not as capable as enterprise-level protections.

Here are a few best practices for preventing cyberattacks:

- Enable Multi-factor Authentication every time it is an option. If you do not see it as an option, ask the vendor.

- Provide email security training for employees. Since phishing is the most common type of attack, employees need to be trained in how to spot them and what to do if they receive one.

- Secure your networks with a combination of security tools like firewalls and NextGen Anti-Virus, and risk assessments, policies, and procedures.

- Have a Disaster Recovery and Incident Response Plan. Plan for what you would do if your business was damaged due to fire, tornado, or if you were hit with Ransomware or data breach. It does not have to be complicated, but it needs to be written and tested.

- Backup your data off-site and run a restore test. You do not want to find out you cannot restore from a backup is when you need to restore from your backup.

Running a small to medium business is hard enough. Do not assume you are too small.

To schedule a 10-minute call to make sure your small business is protected, call us at 888.831.9400 or introduce yourself via the form below!

Let’s Chat!

To receive your free 10-minute discovery consultation, simply introduce yourself via the form. A member of our team will reach out shortly to setup an introductory call.

SPAM NOTICE: We value your privacy and will never share or sell your contact information.